PAYSHIELD RESOLVE

Chargeback Alerts

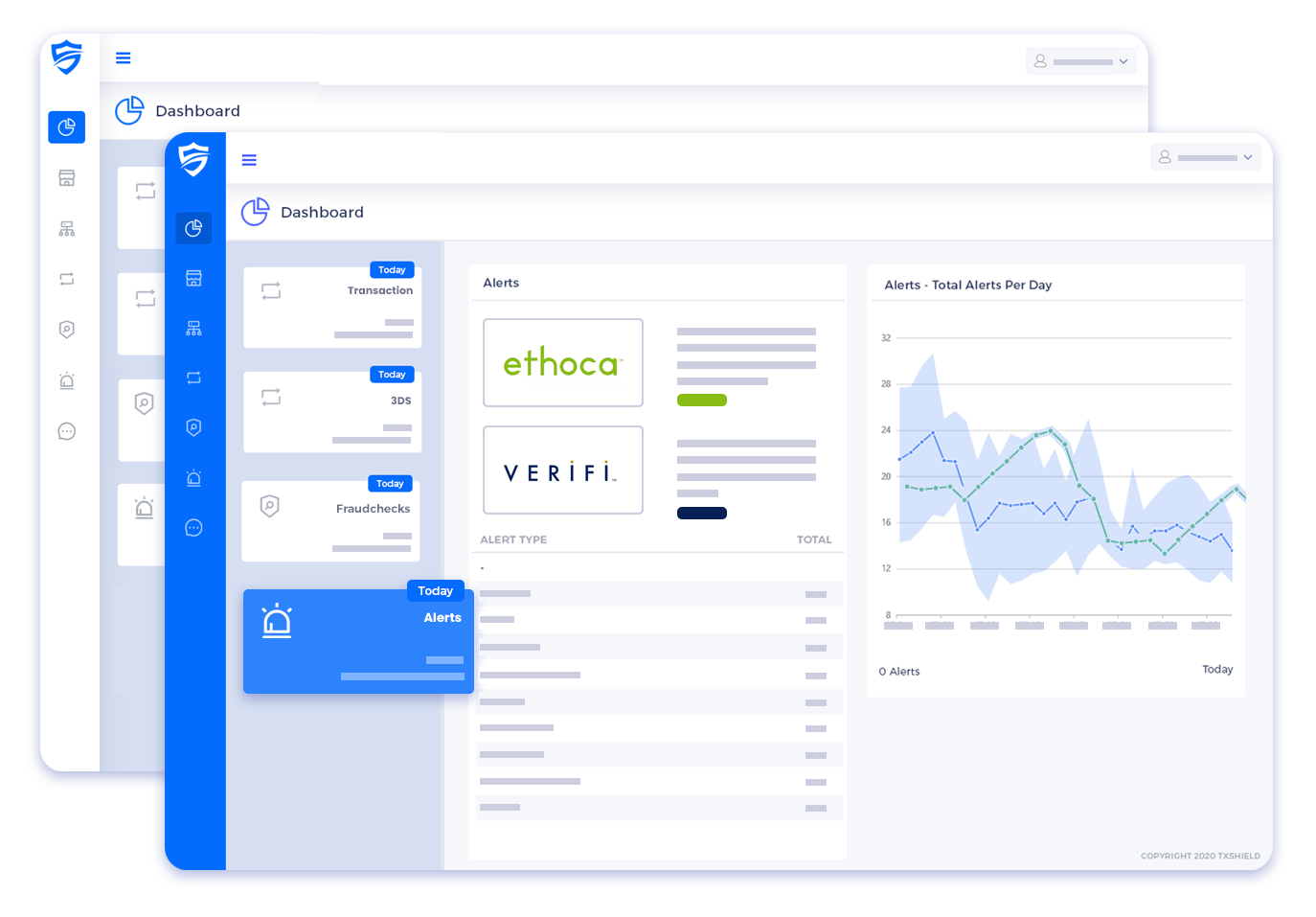

Enhance your business’s dispute resolution capabilities with PayShields Chargeback Alerts Solutions. This comprehensive suite comprises three powerful products: Dispute Intelligence, Ethoca Alerts, and VISA Verifi Alerts. Tailored to address various aspects of chargeback challenges, these solutions collectively provide a robust framework for efficient dispute resolution and fraud prevention.

DISCOVER

What is the Dispute Alerts Suite?

PayShield Dispute Alerts Suite is a robust and versatile set of solutions designed to elevate and streamline your dispute resolution processes. This comprehensive suite includes three powerful offerings: Alert Intelligence, Ethoca Alerts, and VISA Verifi Alerts, each addressing specific facets of the chargeback alerts landscape.

Seller-Decisioned Alerts

Verifi CDRN Alerts

VISA’s robust dispute resolution network. This solution minimizes VISA chargebacks, cuts fulfillment costs, and enables swift dispute resolution.

Ethoca Alerts

Extensive coverage for VISA and MasterCard transactions, providing rapid notification to merchants, and combating disputes efficiently.

Automated Alerts

Verifi RDR Alerts

Revolutionize chargeback management with Dispute Intelligence. Automate refunds, cut fees, and resolve issues swiftly. Works with both Ethoca and VISA Verifi.

Dispute Intelligence

Automate Self-decisioned alerts (Verifi CDRN and Ethoca Alerts) with Dispute Intelligence. Automate alert handling through automated refunds, based on set rules that can be customised by the merchant.

Self-Decisioned Alerts

Self-Decisioned alerts require a manual process where your team, or your individual merchants for ISO’s, PSPS’s and aggregators, action each alert. Buying access to alerts and then processing them internally is one of the most common approaches to managing chargeback alerts. PayShield is highly experienced in setting up solutions that leverage this approach with our own support team ready to get you set up and active quickly.

Alert

Ethoca Alerts

Ethoca Alerts, owned by MasterCard, offers proactive management of payment disputes. Covering a substantial portion of MasterCard and Visa transactions, it provides early notice of potential disputes. Integrated seamlessly into existing software solutions, PayShields Ethoca Alerts offering can ensure a swift resolution workflow, allowing businesses to address issues within 24 hours and effectively manage credit card payment disputes.

- Substantial coverage of both MasterCard and Visa transactions.

- Early notice of potential disputes for prompt resolution

- Seamless integration into existing software solutions

- Swift workflow, address disputes within 24 hours of them occurring

- Fully compatible with Dispute Intelligence

Alert

Verifi CDRN Alerts

VISA Verifi’s two Alerts offerings are an integral part of the Verifi RESOLVE suite and have near full coverage within the VISA transaction network. Verifi RDR ensures rapid automated dispute resolution for VISA transactions, streamlining the refund process with customizable rules. Verifi CDRN meanwhile has extensive coverage in the VISA network and can provide insights on disputes within 72 hours.

- Exemplary coverage over the VISA transaction network

- Can be seamlessly integrated with existing systems

- CDRN can be fully implemented within Dispute Intelligence

Automated Alerts

Automated alerts require more initial effort but rewards adopters with a system that removes user error, reduces staff overheads and ensures chargebacks are dealt with promptly and correctly. In these systems, rules and limits are set up to handle and action incoming chargeback alerts before they become chargebacks. This does not mean that control is lost however as the rules can be set up in a way that, when required, human approval can be reintroduced into the process. PayShield has highly experienced integrations specialists embedded with our support teams allowing us to rapidly scope out your needs and work with you to quickly implement an Automated Alert solution for your business.

PRODUCT

Verifi RDR

Verifi RDR (Rapid Dispute Resolution), offers a groundbreaking solution for automated dispute management. By leveraging predefined rules and automated resolution processes, Verifi RDR enables merchants to resolve disputes at the pre-dispute stage, preventing unnecessary chargebacks and improving customer satisfaction. Key features include:

- Real-time resolution of disputes through auto-refunds.

- Customizable rules tailored to business needs.

- Enhanced customer experience with quick dispute resolutions.

- Visa-certified solution adhering to industry standards.

- Expert support for setting up and optimizing dispute resolution rules.

Product

Dispute Intelligence

PayShield’s Dispute Intelligence transforms chargeback alert resolution. Dispute Intelligence provides merchants with the capability to seamlessly automate the processing of Verifi CDRN and Ethoca alerts. By enabling full or partial automation of refunds and offering customizable rule sets, Dispute Intelligence empowers businesses to gain control over their dispute alerts, significantly minimizing manual intervention. This not only enhances operational efficiency but also leads to lower chargeback ratios, reduced fees, and speedy resolutions.

- Seamless response automation for chargeback alerts

- Customizable rule sets for automatic refunding

- Integrates with existing systems as a headless solution

- Seamlessly resolves Ethoca Alerts and Verifi CDRN alerts

- Compatible with Verifi RDR for notification functionality

- Empowers merchants and providers with full control of the dispute resolution process

Ready to integrate with Alerts?

Featured Articles

Understanding TC40 Cases: What They Are and Why They Matter for Fraud Prevention

In the constantly shifting landscape of risk management and payment fraud, TC40 cases or reports are essential but frequently misunderstood. When a cardholder flags a transaction as fraudulent, issuing banks send Visa these reports, which act as a fraud signalling...

Fraud Risks in Cross-Border Payments and Why International Transactions Are Targeted

In order for businesses to access worldwide markets and serve a diverse customer base, cross-border payments have emerged as an essential part of global commerce. But the increase in international trade has also made businesses more susceptible to fraud. Due to...

Combatting Fraud & Chargebacks in Online Casinos & Sports Betting

In recent years, the online gambling sector, which includes sports betting sites and online casinos, has grown significantly. However, this growth also brings with it a more difficult problem... chargebacks and fraud. Online Gambling is especially...