PAYSHIELD PREVENT

Compelling Evidence

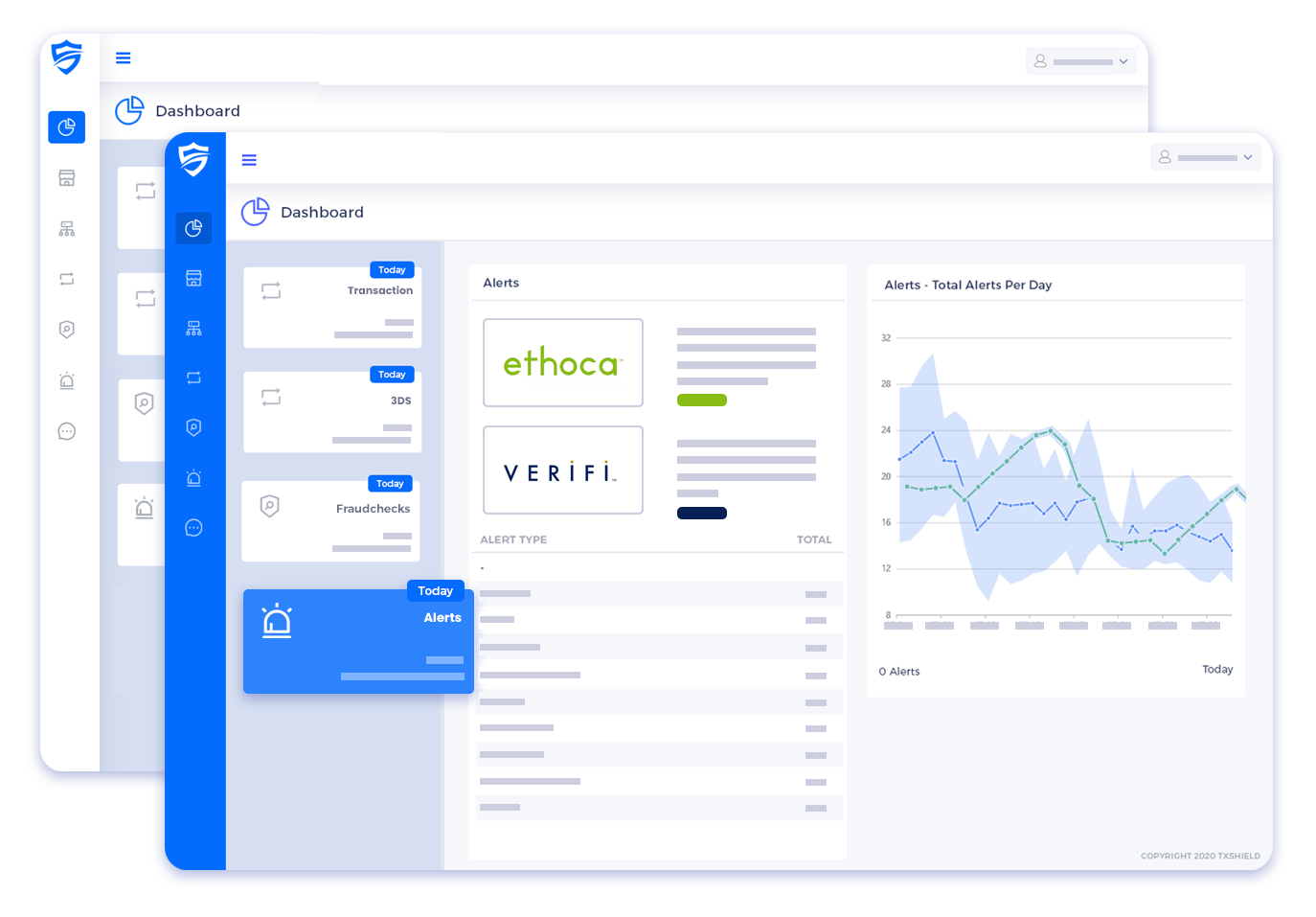

Empower your dispute resolution strategy with PayShield and Compelling Evidence. Our solutions enable Visa’s latest Compelling Evidence 3.0 guidelines, providing a much improved, standardized framework for submitting historical purchase evidence.

DISCOVER

What is Compelling Evidence 3.0?

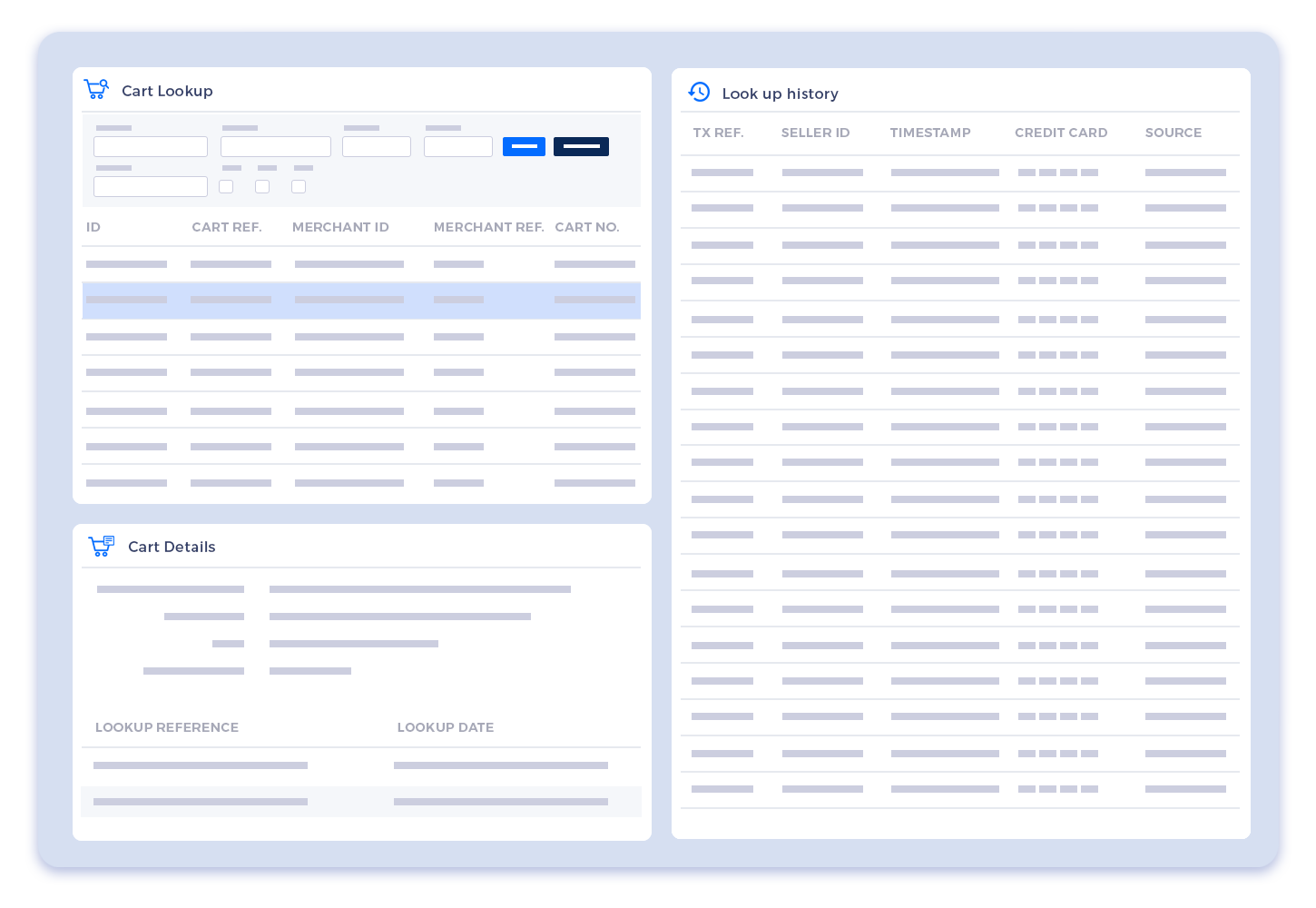

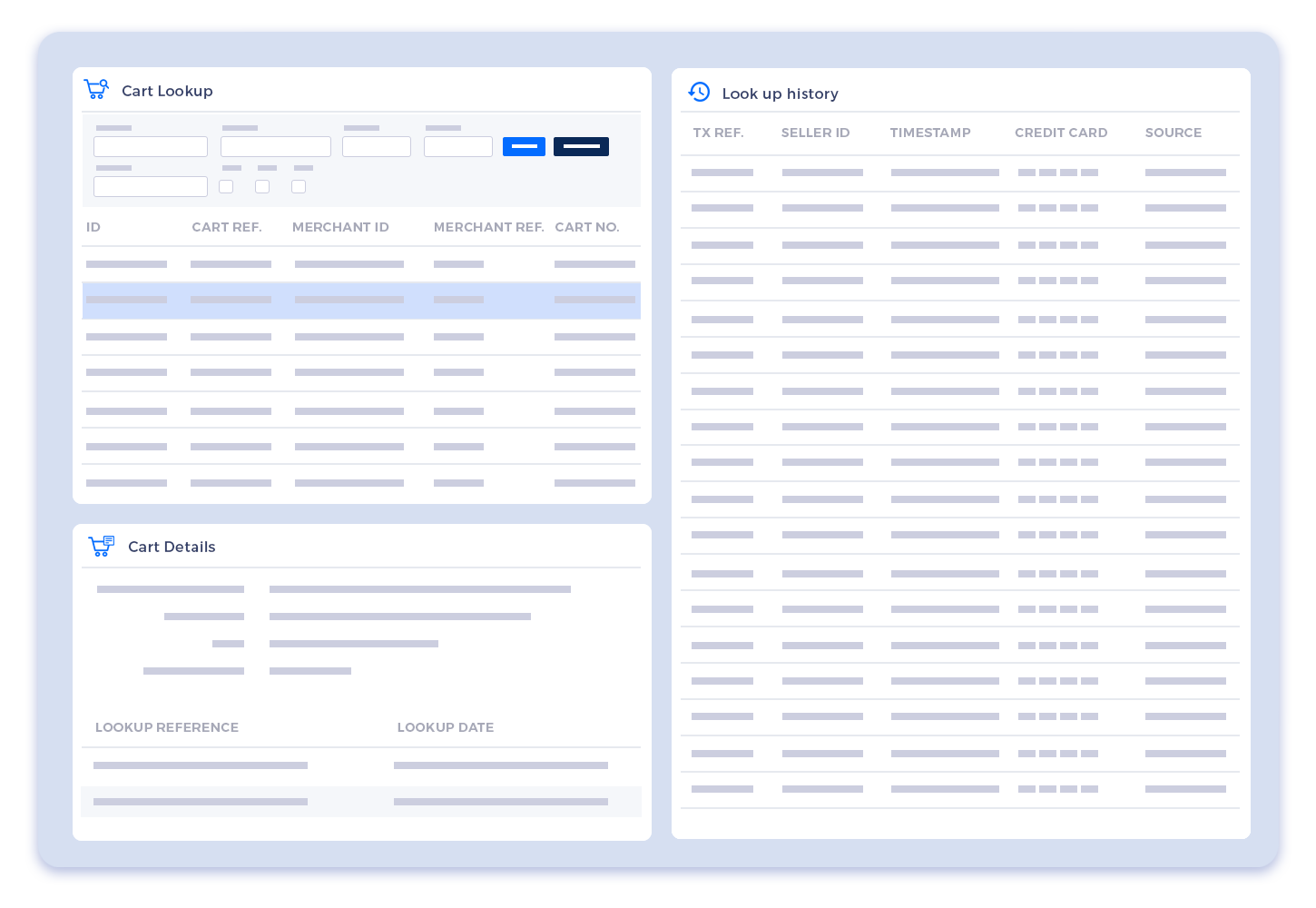

Compelling Evidence 3.0 is Visa’s latest set of guidelines, facilitating standardized evidence submission for merchants dealing with disputed transactions. Key features include improvements to historical purchase evidence submission and reduced data point requirements for matching past transactions. Merchants take advantage of Compelling Evidence 3.0 by integrating with Visa’s Order Insight service.

Visa-Certified Framework

Compelling Evidence 3.0 is Visa-certified, ensuring adherence to their standards for evidence submission.

Historical Purchase Evidence

Merchants can submit historical purchase evidence, including account/login ID, delivery address, device fingerprint, and/or IP address.

Improved Matching Requirements

Only two pieces of evidence need match on each of two prior transactions. Special dispensation for recurring billing.

PROCESS

How Compelling Evidence Works

Customer disputes a transaction. Merchant notified.

Merchant collects historical purchase evidence from prior transactions.

The evidence is evaluated, leading to a resolution of the dispute.

MORE ABOUT

Compelling Evidence

Enhance dispute resolution efficiency by leveraging Compelling Evidence. Seamlessly integrate with Visa’s Order Insight offering through PayShield. For MasterCard transactions, integrate with Mastercard’s Consumer Clarity through PayShield. Benefit from standardized evidence frameworks, quick dispute resolutions, and expert support.

- Visa & Mastercard Certified Solutions

- Use Your Historical Purchase Evidence

- Special Consideration for Recurring Billing Transactions

- Avoid Chargebacks

- Full Integration Support

Ready to integrate with Compelling Evidence?

Featured Articles

Why Chargebacks Are Still a Problem in 2025

In 2025, chargebacks are still a recurring and increasing problem to merchants despite advancements in fraud and chargeback protection. The main issue is that traditional defenses are still lagging behind the development of first-party fraud, in which real customers...

Everything you need to know about VAMP in 2025

What Is VAMP and What Changed in 2025? Visa’s Acquirer Monitoring Program (VAMP) is a global initiative to monitor and control fraud and dispute levels across the payments ecosystem. The number of transactions that are reported as fraudulent (TC40s) or disputed...

Are You a Target? Industries Facing the Highest Rates of Fraudulent Chargebacks

Businesses in North America and Europe are becoming increasingly concerned about fraudulent chargebacks in today's digital-first economy. Although chargebacks were initially meant to protect customers from actual fraud, a number of companies are currently dealing...